Writer: Eric Bearing Limited

The global automotive and industrial supplier Schaeffler presented its Roadmap 2025 yesterday at its 2020 Capital Market Day (CMD). The Roadmap 2025 updates Schaeffler’s business strategy to 2025, sets out a program for its implementation, and includes a set of medium-term targets. The medium-term targets for 2025 had been published after the markets closed on November 17 and were explained further at yesterday’s CMD. The main part of the event comprised presentations by Schaeffler’s three divisional CEOs, who discussed the growth opportunities and value creation potential of their respective divisions.

Strategic priorities in the Roadmap 2025

At the start of the event, Klaus Rosenfeld, CEO of Schaeffler AG, emphasised that the Roadmap 2025 does not mark any radical change in strategic direction. The approach is rather to hold to the current course in areas where continuity has proven successful, to focus even more clearly on the company’s strengths, and to improve in areas where there is ground to make up. The new corporate claim, “We pioneer motion”, expresses Schaeffler’s commitment to continuing to shape motion and progress by being a diversified automotive and industrial supplier with a global reach, he said. This will require even more effective use of the synergies available within the Schaeffler Group, he added. The company’s success will continue to be based on its four proven key differentiators of innovation, manufacturing excellence, top quality, and system understanding. At the same time, he said, Schaeffler also needs to continue its transformation and to focus on core expertise and its consistent implementation.

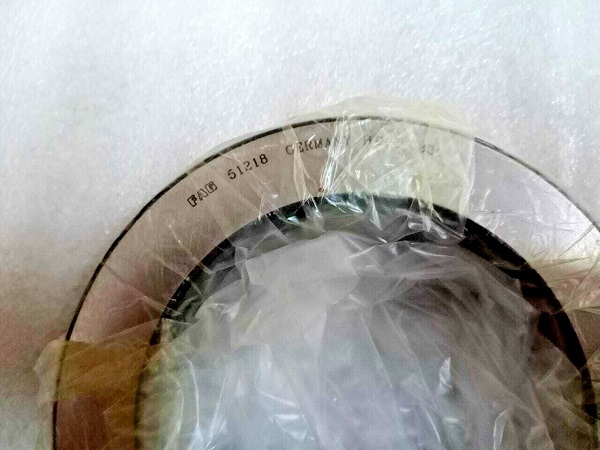

In the Automotive Technologies division, this essentially means accelerating the portfolio’s transition towards electric mobility and chassis applications. The priority in the Automotive Aftermarket division will be to maintain the existing high margin, while focusing on utilising opportunities for growth in the independent aftermarket segment. The Industrial Division will be looking to enter new growth sectors and consistently continue to increase its profitability, he said. FAG 51218 bearings online , pls click here :

All of these measures will continue to be implemented consistently and with strict operational discipline. The focus here will remain on the creation of free cash flow and the convincing allocation of capital within the Group. The objective is to sustainably create added value in the long term.

Rosenfeld identified five key future trends that open up special opportunities for the Schaeffler Group: (1) sustainability and climate change, (2) new mobility and powertrain electrification, (3) autonomous production, (4) the data economy and digitalisation, and (5) demographic change. Based on these trends, Schaeffler has formulated five areas in which the company wants to further enhance its position. These areas encompass the products and services of all three divisions as well as the ten cross-divisional customer sectors and sector clusters.

The Schaeffler Group sees strong growth potential in sectors such as hydrogen technology, for example – both in the form of fuel cells for mobile applications and electrolyzer equipment for green hydrogen production: “The Schaeffler Group sees a significant opportunity for growth in the hydrogen sector. With our manufacturing excellence and industrialisation expertise, we are outstandingly positioned to offer our customers high quality solutions and to benefit from the expansion of renewable energies,” Rosenfeld said.

The issue of sustainability is of higher-level significance for the Schaeffler Group. To this end, the company is pursuing an integrated approach across all divisions, functions, and regions. The objective is to achieve CO2-neutral production operations from 2030 onwards.

Automotive Technologies: Aiming for innovation leadership in the electric powertrain segment

Matthias Zink, CEO Automotive Technologies, began his presentation with some remarks on the continuing high level of uncertainty in the automotive sector, on which he said the COVID-19 pandemic has had a particularly severe effect, coming on top of the fundamental structural transformation that was already underway. A conservative planning approach is therefore required, combining strict cost discipline with a measure of flexibility, he said.

Focusing on the powertrain segment, Zink extended Schaeffler’s “Vision Powertrain 2030”, which is based on global production of passenger cars and light commercial vehicles, out to the year 2035. The pace of electrification is set to increase sharply, with battery and fuel cell-powered vehicles (xEV) surging to 50 per cent of the fleet, and hybrid drives (HEV) and internal combustion engines (ICE) declining to 35 and 15 per cent, respectively.

Schaeffler will need to take this change into account in its portfolio management and capital allocation decisions, he said. Mature business areas with less growth potential will need a stronger focus on profitability and efficiency, with higher investment going into future technologies and new business. For the foreseeable future, however, HEV and optimised ICE drives will remain important for stabilising margins and generating free cash flow, partly as a means of funding growth in new business areas. The implementation of measures to boost efficiency and reduce complexity within the Automotive Technologies division will continue, he said.

Dr. Jochen Schr?der, head of the E-Mobility business division, highlighted the high volumes of incoming orders in the electric mobility sector, which amounted to EUR 4 billion in 2019 and over EUR 1 billion in the first half of 2020. The annual electric mobility order intake target for the period up to and including 2021 is EUR 1.5-2 billion, he noted, while the target for the period after that is an average of around EUR 2-3 billion per year. He highlighted the construction of a plant for electric motor production in Hungary, the location of a state-of-the-art electric mobility Competence Centre in Bühl, success in gaining an established position as a supplier of “3in1” electric axles, and the manufacture of electric motor components for trucks in the USA. There is also very promising potential for fuel cell technology for trucks in particular, he said. This is an area in which the Schaeffler Group is building a position across divisions as part of its hydrogen technology initiatives.

There are also some success stories in the field of chassis applications as enablers of self-driving vehicles. Schr?der cited a partnership with Bosch for rear-wheel steering systems and the Schaeffler Paravan joint venture, which is currently involved in the development of steer-by-wire solutions.

As medium-term targets for 2025, the Automotive Technologies division is aiming for revenue growth in constant currency terms of 200-500 basis points on average above the growth in the global production of passenger cars and light commercial vehicles. The target EBIT margin before special items is 4-6 per cent, with the lower end of that range to be reached by 2023 at the latest.

Tel: 00852-30697500

Fax: 00852-30697511

Email: sales@ericbearing.com

Message: Click Here Message!